As the CFO of an investment management firm, have you ever wondered “if we change some of our fee schedules, how would that impact our revenue next year?” An easy question to ask, not so easy to answer. Now, factor in a variety of market returns, expected cash flows, starting valuations and all the nuances of your current fee schedules. Starting to sound like a giant spreadsheet project?

Arcons Technology has created a forecasting feature in billPort that analyzes all pertinent billing data. With a couple of clicks you can create multiple forecasts from your existing data, add the exact input you want to see and create a variety of projections that can be used in decision making.

With billPort it is easy to forecast revenue for all or a portion of your accounts. Start with your existing client data and fee structures, then define the inputs that you want to use such as:

- Valuation date

- Forecast period

- Billing interval

- Projected market returns

- Projected net cash flows

Now run those numbers then answer the “What if” question:

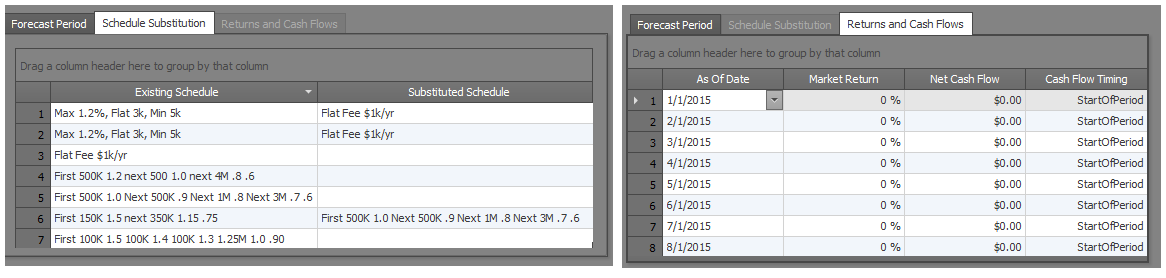

- Schedule Substituion – click to replace any number of old fee schedules with new ones

Output is instantly created that can be exported and analyzed. During the next year if your projections change, run the forecasting again and see how it looks for the next twelve months. Are you on track for the year or do you need to make some changes? billPort provides the tool to make those decisions.

billPort is a critical management tool for investment firms today. Client billing is the most important source of revenue and management needs timely information in a way that assists srategic decision making.